does wyoming have taxes

Wyoming follows the rule of no state income tax which means no estate tax no state gift tax no funds gains tax. Including local taxes the Wyoming use tax can be as high as 2000.

File Taxes Online Do You Live In A No Income Tax State While All Us Taxpayers Have To Pay Federal Income Taxes Not Every State Has An Income Tax There Are

Wyoming repealed its estate tax as of January 1 2005.

. Wyoming Sales Tax Rates. Wyoming has no state income tax. You can see all the.

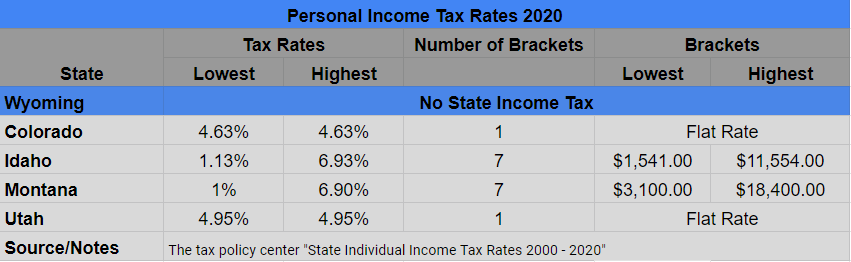

Wyoming is one of seven states that do not collect a personal income tax. Does Wyoming have state income tax. How to Calculate Property Taxes in Wyoming.

Up to 25 cash back Franchise taxes are generally either a flat fee or an amount based on a businesss net worth. Wyoming does have sales tax. If you have questions about potential rates for a new employer please call the Unemployment Tax Helpline at 307-235-3217.

So taxes you pay are comparatively low in the country which makes Wyoming. NO INHERITANCE OR ESTATE TAX. Wyoming does not assess any state inheritance tax.

More on Wyoming taxes can be found in the tabbed pages. Is Wyoming tax-friendly for retirees. Wyoming does not have a state income tax so employers are not required to register for state income tax withholding.

You May Like. Wyoming is the best state to retire in according to a list from Bankrate. The Wyoming use tax rate is 4 the same as the regular Wyoming sales tax.

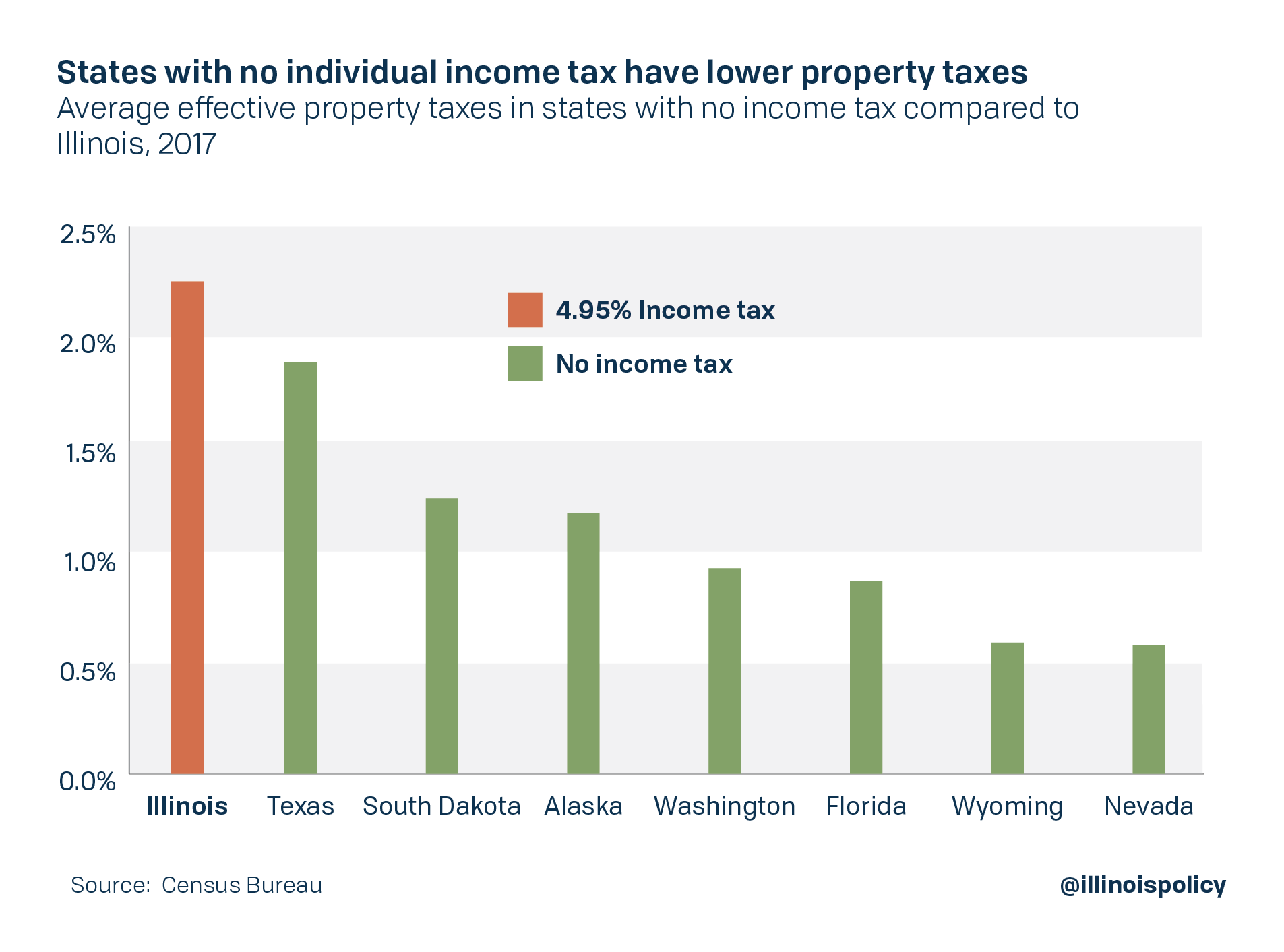

As just mentioned Wyoming is one of just a few states that have neither. In fact at just 061 it has the eighth lowest average effective. It does not have its own income tax which means all forms of retirement income will not be.

Wyoming Nonprofit Tax Exemptions Certain nonprofit entities registered in Wyoming may be able to exempt some or all of their qualifying income from Wyoming and federal income taxes. Do You Have To Pay Taxes On Plasma Donations. The group ranked all 50 states based on weather cost of living crime quality of health care state and.

It does collect a state sales tax and counties have the option of adding an additional 1 to the state levy. You are still required to withhold federal income taxes. Wyoming has among the lowest property taxes in the US.

The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000. However revenue lost to. Only the Federal Income Tax applies.

Are Other Forms Of Retirement Income Taxable In Wyoming. The states sales tax rate is 40. Wyoming does not tax any income.

Taxability Specialists in this section answer the myriad of questions which vendors and taxpayers have regarding how the various taxes and exemptions affect their businesses by. Municipalities however can impose local sales taxes which will increase. Refund of Unemployment Credit In some instances employers may.

Counties in Wyoming collect an average of 058 of a propertys assesed fair. Wyoming may be the most tax-friendly state south of Alaska. Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming do not levy state income taxes while New Hampshire doesnt tax earned wages.

Illinois Property Taxes Rank No 2 In The Nation For Third Year Running

Wyoming The Lesser Known Trust Situs First Republic Bank

Wyoming Sales Tax Rates By City County 2022

Personal Property Taxes For Entrepreneurs Wyoming Small Business Development Center Network

Wyoming Taxes Wy State Income Tax Calculator Community Tax

Pandora Papers Wyoming Other U S Tax Havens Provide Scant Oversight Of Registered Agents Washington Post

Startup Culture How Does Wyoming Delaware And Florida Compare To Texas Fort Worth Weekly

Wyoming Income Tax Calculator Smartasset

States That Tax Social Security Benefits Tax Foundation

9 Us States That Don T Charge State Income Taxes

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole

The Inconvenient Truth About The Convenience Rule Lendami

Costs Fees To Form And Operate An Llc In Wyoming Simplifyllc

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

States With No Personal Income Tax Myroyalfinancial

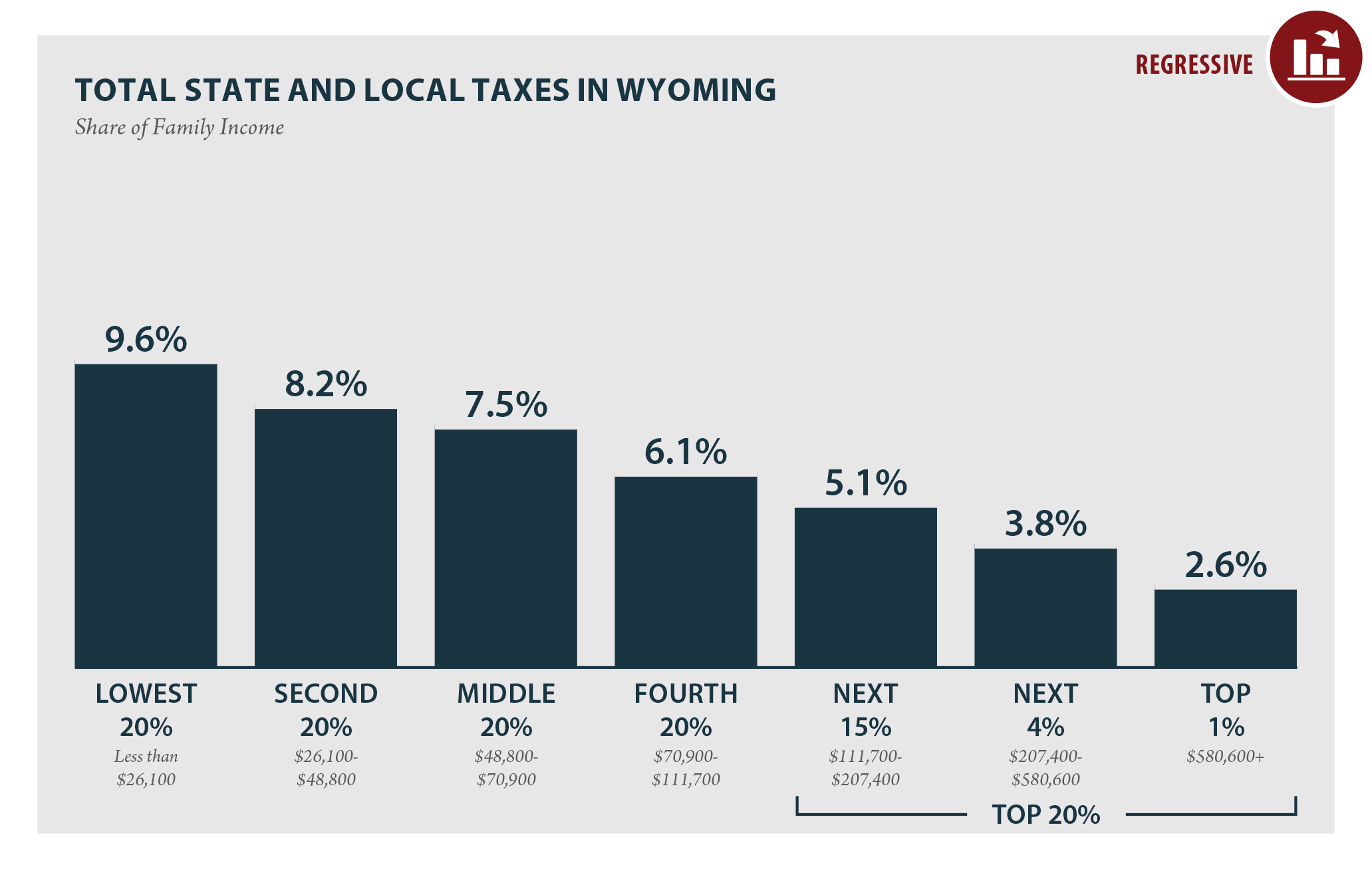

Wyoming Who Pays 6th Edition Itep

States With No Estate Tax Or Inheritance Tax Plan Where You Die